The 30-year fixed-rate mortgage jumped 12 basis points from last week, averaging 3.69%, Freddie Mac reports. That’s no reason for home shoppers to get nervous: Economists largely predict mortgage rates will dip in the weeks ahead. Also, rates are still more than a percentage point lower than a year ago.

“Despite this week’s uptick in mortgage rates, the housing market remains on the upswing, with improvement in construction and home sales,” says Sam Khater, Freddie Mac’s chief economist. “While there has been a material weakness in manufacturing and consistent trade uncertainty, other economic trends like employment and homebuilder sentiment are encouraging.”

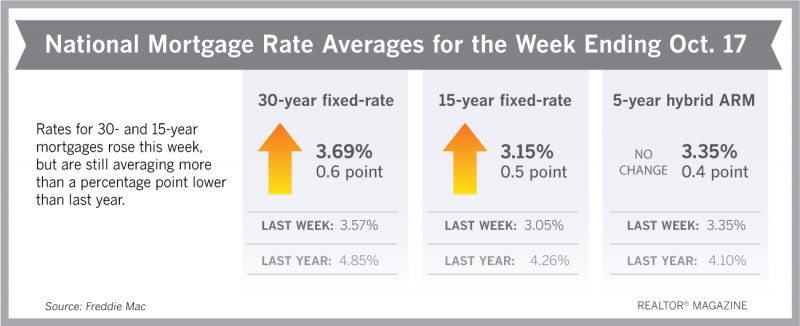

Freddie Mac reports the following national averages with mortgage rates for the week ending Oct. 17:

- 30-year fixed-rate mortgages: averaged 3.69%, with an average 0.6 point, rising from last week’s 3.57% average. Last year at this time, 30-year rates averaged 4.85%.

- 15-year fixed-rate mortgages: averaged 3.15%, with an average 0.5 point, rising from a 3.05% average last week. A year ago, 15-year rates averaged 4.26%.

- 5-year hybrid adjustable-rate mortgages: averaged 3.35%, with an average 0.4 point, unchanged from last week. A year ago, 5-year ARMs averaged 4.10%.

Source: Freddie Mac