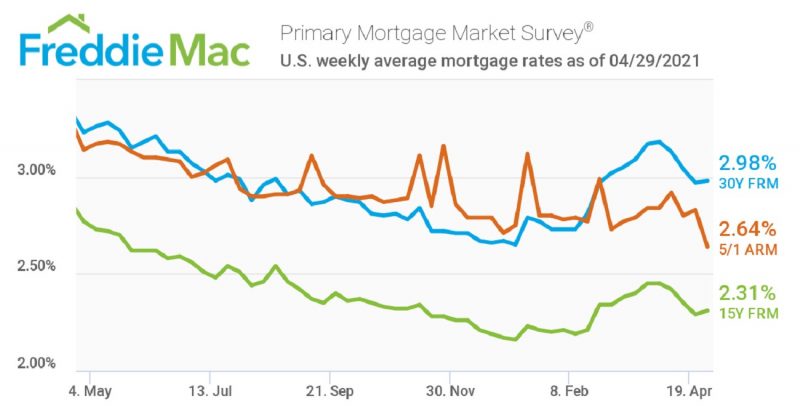

Home buyers had another opportunity to snag ultra-low rates this week. The 30-year fixed-rate mortgage averaged 2.98%, Freddie Mac reports.

“In light of the rising COVID-19 caseloads globally, U.S. Treasury yields stopped moving up a month ago and have remained within a narrow range as the market digests incoming economic data,” says Sam Khater, Freddie Mac’s chief economist. “The good news is that with rates under 3%, refinancing continues to be attractive for many borrowers who financed before 2020. But for eager buyers, especially first-time home buyers, inventory continues to be extremely tight, and competition for available homes to purchase remains high.”

The National Association of REALTORS® estimates mortgage rates to average 3.2% by the end of the year.

Freddie Mac reports the following national averages with mortgage rates for the week ending April 29:

- 30-year fixed-rate mortgages: averaged 2.98%, with an average 0.7 point, rising slightly from last week’s 2.97% average. Last year at this time, 30-year rates averaged 3.23%.

- 15-year fixed-rate mortgages: averaged 2.31%, with an average 0.7 point, increasing from last week’s 2.29% average. A year ago, 15-year rates averaged 2.77%.

- 5-year hybrid adjustable-rate mortgages: averaged 2.64%, with an average 0.3 point, dropping from last week’s 2.83% average. A year ago, 5-year ARMs averaged 3.14%.

Freddie Mac reports average commitment rates along with average points to better reflect the total upfront cost of obtaining a mortgage.

Source: Freddie Mac and “Instant Reaction: Mortgage Rates, April 29, 2021,” National Association of REALTORS® Economists’ Outlook blog (April 29, 2021)