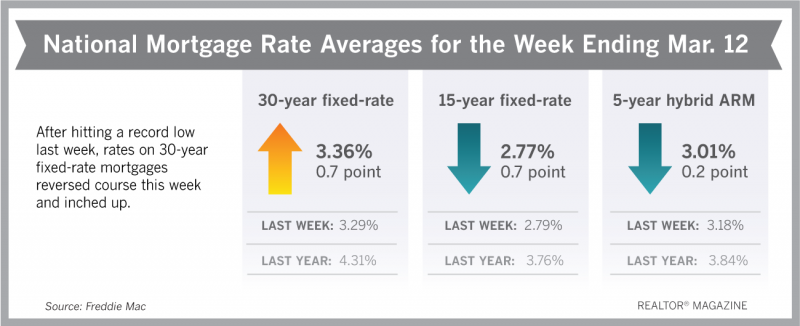

After hitting a record low last week, rates reversed course this week and inched up. Rates still remain at “extraordinary levels,” Freddie Mac said in its weekly rate report.

The 30-year fixed-rate mortgage climbed from last week’s 3.29% record low average to 3.36% this week.

“As refinance applications continue to surge and lenders work to manage capacity, the 30-year fixed-rate mortgage ticked up from last week’s all-time low,” says Sam Khater, Freddie Mac’s chief economist. “Mortgage rates remain at extraordinary levels and many homeowners are smartly weighing their options to refinance, potentially saving themselves money.”

Freddie Mac reported the following national averages with mortgage rates for the week ending March 12:

- 30-year fixed-rate mortgages: averaged 3.36%, with an average 0.7 point, rising from last week’s 3.29% average. Last year at this time, 30-year rates averaged 4.31%.

- 15-year fixed-rate mortgages: averaged 2.77%, with an average 0.7 point, falling slightly from last week’s 2.79% average. A year ago, 15-year rates averaged 3.76%.

- 5-year hybrid adjustable-rate mortgages: averaged 3.01%, with an average 0.2 point, falling from last week’s 3.18% average. A year ago, 5-year ARMs averaged 3.84%.

Source: Freddie Mac