For the second week in a row, mortgage rates climbed from their lowest levels on record. But economists reminded borrowers that rates continue to be near historic lows. The 30-year fixed-rate is still significantly below what it was a year ago. “Mortgage rates rose again this week as lenders increased prices to help manage skyrocketing refinance demand,” says Freddie Mac Chief Economist Sam Khater. “On the purchase front, daily loan purchase applications were rising as of mid-February but started to decline last Friday.”

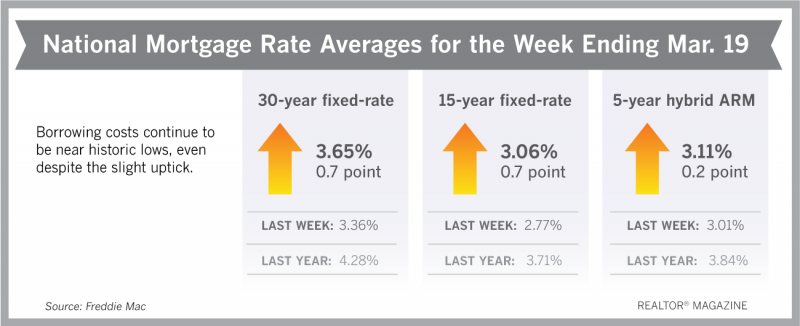

Freddie Mac reports the following national averages with rates for the week ending March 19:

- 30-year fixed-rate mortgages: averaged 3.65%, with an average 0.7 point, rising from last week’s 3.36%. Last year at this time, 30-year rates averaged 4.28%.

- 15-year fixed-rate mortgages: averaged 3.06%, with an average 0.7 point, rising from last week’s 2.77% average. A year ago, 15-year rates averaged 3.71%.

- 5-year hybrid adjustable-rate mortgages: averaged 3.11%, with an average 0.2 point, rising from last week’s 3.01% average. A year ago, 5-year ARMs averaged 3.84%.

Source: Freddie Mac